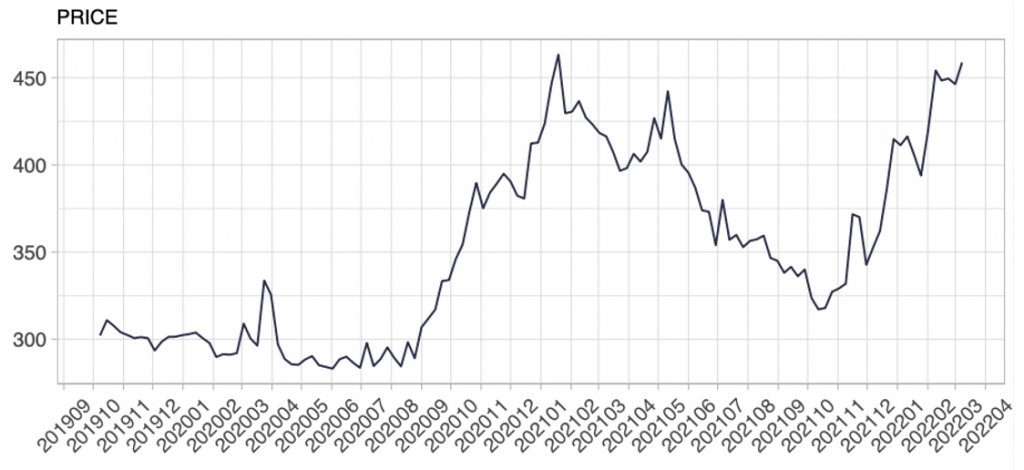

Since October 2019

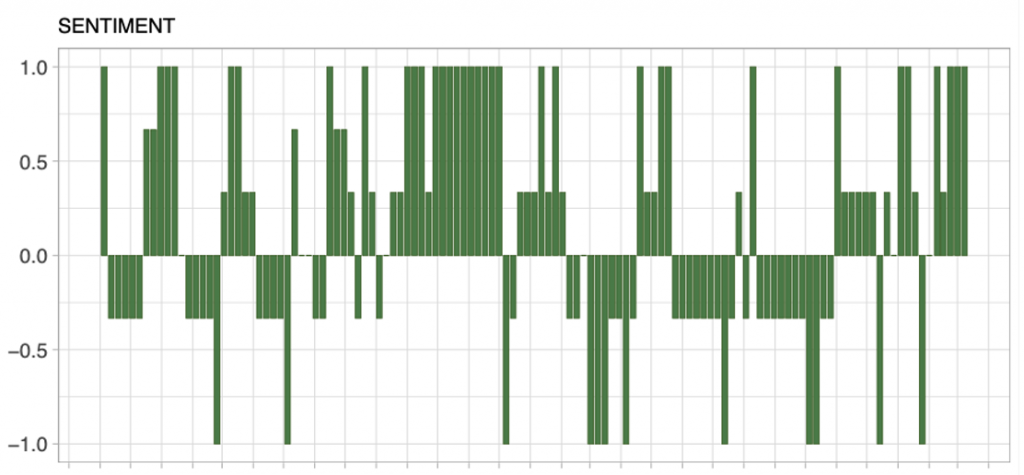

We run surveys where we ask commodity traders their expectations about the prices for corn, soybean meal, and wheat. Weekly we ask them what they think the price will be after one week and what the price can be maximally and minimally. What makes this data unique is that it shows expectations and uncertainty among traders, which can be used for trading, price outlooks, and research.